Your car logbook made simple

Easy and automated trip logging. Accurate and ATO compliant car logs. All you need is your phone, and you’re good to go.

Trusted by millions of users

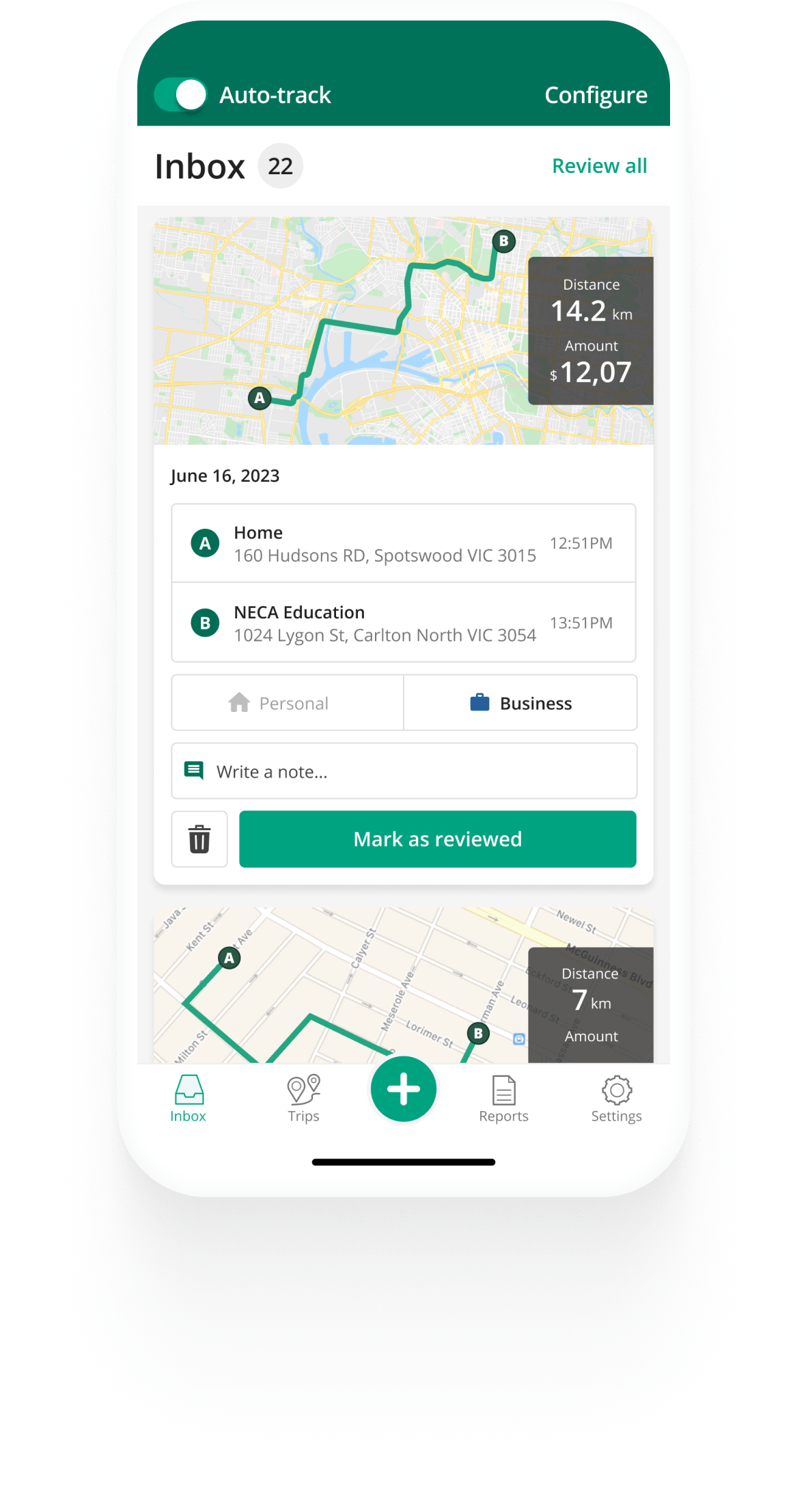

Auto-track

Track trips from your pocket

With Driversnote as your automatic mileage tracker, you can record trips without even opening the app. The motion detector lets you auto-track trips - all you have to do is drive. And if you forget to track, you can easily create manual trips later.

Read more Sign upWhat our customers say about us

Great App This app is great & so easy to use. Helps so much to keep track of kilometres & distance traveled. Definitely recommend

Absolutely brilliant app. Never had any issues with the Tax department since using DriversNote. Very helpful support staff and an all around great company to deal with.

Seems to be doing a great job of producing a human readable (and spreadsheet exportable) log of my driving, with minimal effort. Thank you for the well designed tool!

Great app Had to use this for work. Brilliant, easy to use, great reporting for month/year end. Highly recommend it.

Great app, good value and great service This app does what it says. It is useful and cost effective and easy to use. Even better their support team is super responsive. I asked a few questions and got a super speedy professional and friendly response. Highly recommended.

Great app to log work trips and record for tax purposes or reimbursable vehicle expenses

Great app Had to use this for work. Brilliant, easy to use, great reporting for month/year end. Highly recommend it.

Great app, good value and great service This app does what it says. It is useful and cost effective and easy to use. Even better their support team is super responsive. I asked a few questions and got a super speedy professional and friendly response. Highly recommended.

Great app to log work trips and record for tax purposes or reimbursable vehicle expenses

I drive over 100 miles a day for work, and I could not do this job as well without this mileage tracker. It's simple, easy to use, and takes care of all my mileage documentation for taxes.

Driversnote is a brilliant journey tracking system. No more need to keep writing down mileage, etc. This system automatically logs all journeys for you. I would highly recommend it to others.

looking good so far. Auto tracking seems to work well, will turn on pro features in a week

I drive over 100 miles a day for work, and I could not do this job as well without this mileage tracker. It's simple, easy to use, and takes care of all my mileage documentation for taxes.

Driversnote is a brilliant journey tracking system. No more need to keep writing down mileage, etc. This system automatically logs all journeys for you. I would highly recommend it to others.

looking good so far. Auto tracking seems to work well, will turn on pro features in a week

The features that make mileage tracking less of a pain

Create locations

Track your trips faster by saving frequently visited places.

Multiple vehicles

Track mileage and keep separate logs for multiple vehicles.

Multiple Workplaces

Track mileage and keep separate logs for multiple workplaces.

Work Hours

Set your work hours and let the app categorise your trips automatically.

Reporting Reminders

Submit your mileage reports on time, every time. We'll simply notify you when it's time.

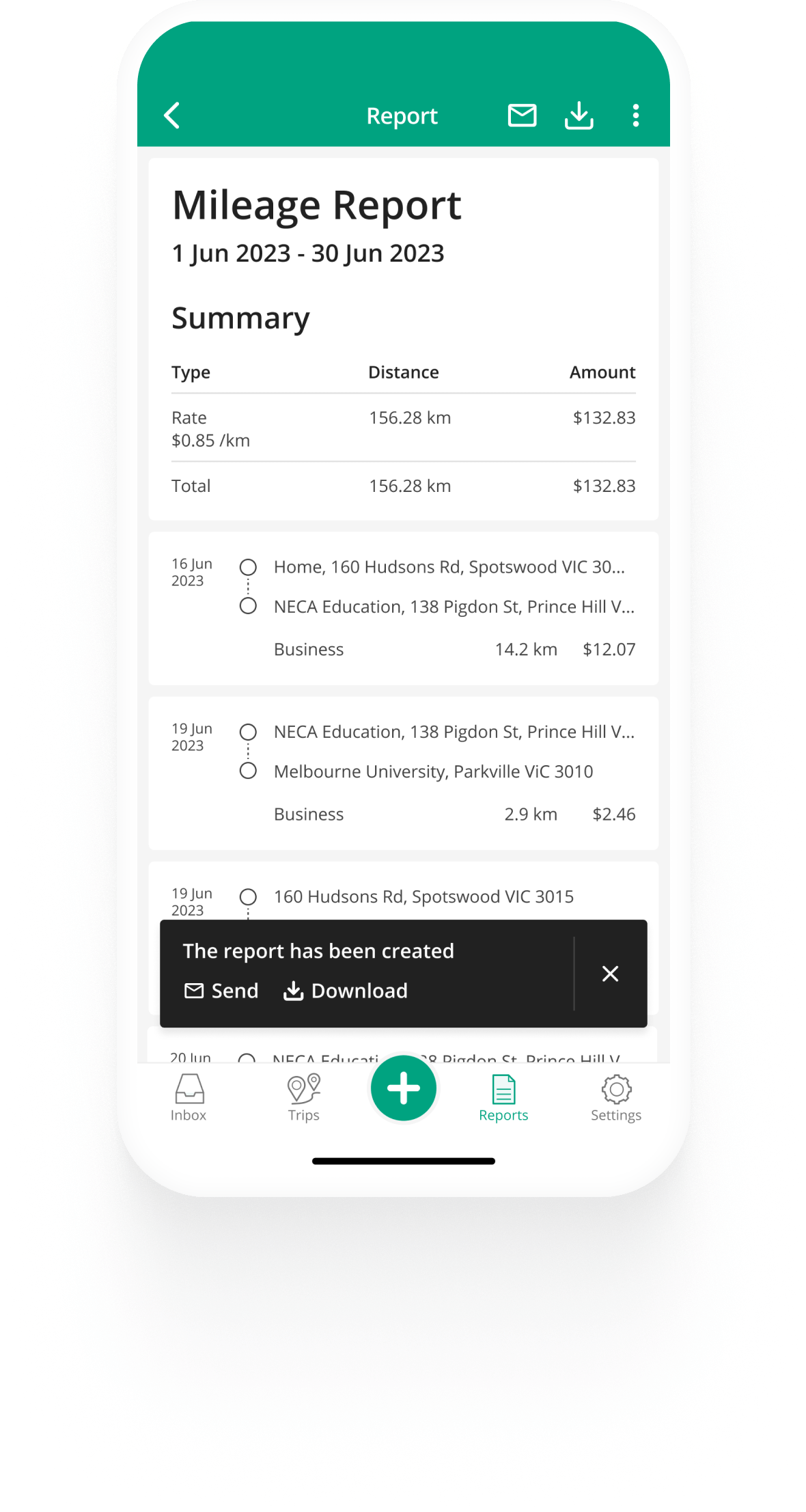

Custom Mileage Rates

Customise your log book with the mileage rates you are reimbursed at.

Odometer Log

Add odometer readings, and get reminders for a complete logbook.

Track Trips Manually

Log manual trips and we'll calculate the distance for you.

Team Management

Review and approve mileage claims for your organisation with ease. Contact us to learn more.

Work Hours

Set your work hours and let the app categorise your trips automatically.

Reporting Reminders

Submit your mileage reports on time, every time. We'll simply notify you when it's time.

Custom Mileage Rates

Customise your log book with the mileage rates you are reimbursed at.

Odometer Log

Add odometer readings, and get reminders for a complete logbook.

Track Trips Manually

Log manual trips and we'll calculate the distance for you.

Team Management

Review and approve mileage claims for your organisation with ease. Contact us to learn more.

Get started for free

Never miss a trip

We've got you covered, and it's easy to get started, and even easier to keep going.

Top posts

ATO Log Book Requirements

Latest update: 18 June 2025 - 5 min read

Are you required to keep a car log book for tax? Do you need to record odometer readings? Overview of the requirements in Australia in 2025.

Find the Best Car Log Book App

Latest update: 25 June 2024 - 2 min read

The days of manually documenting a week's worth of information and struggling to remember the work errand you were running around 6:30 p.m. last Thursday are long gone, thanks to mobile apps that track your trips and produce compliant mileage logs.

How To Keep a Car Log Book

Latest update: 26 June 2024 - 2 min read

Find ATO's requirements for keeping compliant log books of your business driving for the logbook or the cents per km method.

Frequently Asked Questions

If you travel for work you should keep a detailed car log for tax in order to receive full KM reimbursement. If you drive often, an automatic car log book app like Driversnote will save you time.

The Driversnote log book app works great for both self-employed and employees. You are able to keep timely records of both personal and business driving with automatic tracking and submit compliant mileage records.

Yes! Driversnote offers a Team solution for companies. Employees can track their trips and submit their ATO compliant car logs on time. The team manager or accountant receives consistent mileage reports all in one place. See more about our Team solution.

.svg)